Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

5.1. Setting the scene – Definition and Design Phase

The survey was the brain child of the former CEO of Fresenius Kabi, Mr. Rainer Baule, who wanted to learn, how customers see FK’s performance in the business field of generic i.v. drugs, four years after having added oncology drugs to the i.v. generic drugs range. Before his retirement in December 2012, Mr. Baule wanted to identify the drivers for Fresenius Kabi’s future growth by analyzing the key customer satisfaction factors affecting the company at a global level. In short, the key objective for this survey was to check the pulse of Fresenius Kabi customers in regions and uncover the level of and values determining satisfaction now and over the coming years.

These considerations were based on the following:

- Generate representative and meaningful research insights

- Tailor research to individual regional and market circumstances; FK to share intelligence on regional/market environment to inform development of survey framework

- Allow for potential repeat research in 18 - 24 months

In order to get a general overview, all sales regions were asked to participate, which are:

- Region EME

- Region ELAMA

- Region AP

- Region NAM

The scope of the survey was limited to the Fresenius Kabi’s injectable portfolio. These drugs are pharmaceuticals which are administered into veins, muscle tissue or under the skin. The FK portfolio includes anti-infectives used for treatment of infection diseases, anesthetics and analgesics for sedation and pain management and other drugs used in the treatment of critically and chronically ill patients, which includes the following product groups:

- A & A (Anesthetics & Analgesics)

Anesthetics are drugs that cause insensibility to pain with or without the loss of sensation and or consciousness. Anesthetics can be used in the body at a local, regional or general level. A commonly known and used example is Propofol for preoperative induction and maintenance of anesthesia during surgery.Analgesics are drugs used for pain therapy and pain relief. The most well known one is Paracetamol. - Anti-Infectives

An anti-infective drug is used to treat an infection. This product group contains antiseptics, antibiotics, antifungals and virucidal agents. - Oncology or Cancer Drugs

An oncology or cytotoxic drug is any drug that is used to control or kill cancer cells. These drugs are highly toxic, poisonous also to non-cancerous living cells and therefore there is a strong focus and emphasis on prevention of inadvertent contact with these agents. - Drugs for Critical Care

These kinds of drugs are used for emergency or intensive care patients. These drugs are primarily used for patients with acute, life-threatening illness or injuries.

The table below gives an overview on FK generics sales in the most important countries:

Market <a href=">Portfolio Overview" class="wp-image-10700 size-full" height="568" src="https://sgbs.ch/wp-content/uploads/Table-4-Market-Portfolio-Overview.png" width="427"> Table 4: Market Portfolio Overview

The current sales, market shares and growth potentials in countries have been used to identify key markets for assessment of customer satisfaction. Other factors for choosing suitable countries were FK presence in this country and a product portfolio of at least 2 out of 4 key injectable product groups:

Table 5: Country Selection and clustering

After exploring the different models for the customer feedback survey, it was decided to do an independent quantitative survey with customer databases generated in key countries by FK local offices. The survey was designed and implemented by an independent market research agency, BDRC Continental, with a proven record in customer satisfaction research. The survey was then conducted by means of a thirty minute online questionnaire.

Different research methods:

Figure 12: Research methodologies – quantitative & qualitative survey

In general following methodology was agreed on:

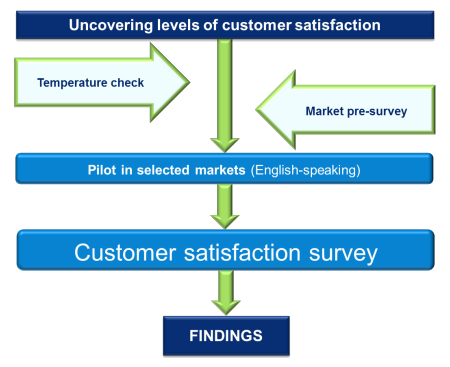

Figure 13: Methodology for FK customer satisfaction survey