Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

4.3.3. Investment portfolio strategies of pension funds

The investment strategies of Pension Funds are to a large degree regulated by authorities, whose ultimate interest is to mitigate the risk of a failing country’s pension scheme.

But apart from the regulations, Pension funds need to follow the strategic focus (funded/unfunded and DB/DC) and further have to balance the differing interest of the stakeholders. Young members would always vote for a higher risk/ chance level than older or retired members, and sponsors are always interested in low cost solutions.

The balance between old and young members can be addressed through a flexible investment portfolio that is influenced by the fund’s maturity (average of the members’ age) and with increasing maturity the fund will reduce volatility and exposure to market volatility.

Portfolio strategy for Pension funds" class="wp-image-11396 size-full" height="152" src="https://sgbs.ch/wp-content/uploads/Illustration-16-Risk-Profile-over-Maturity-Portfolio-strategy-for-Pension-funds.png" width="256"> Illustration 16: Risk Profile over Maturity; Portfolio strategy for Pension funds

Maturity and cash position

The maturity consequently also affects the cash position of a fund. Immature funds are cash positive as the contribution are higher than the pensions. At some point in the are time of the fund the maturity might change and the rate of paid pensions increases the rate of contribution. From this date on the fund is depending on the cash flow from its assets (in cae of funded funds) and therefore seeks more secure investments with stable and less volatile income.

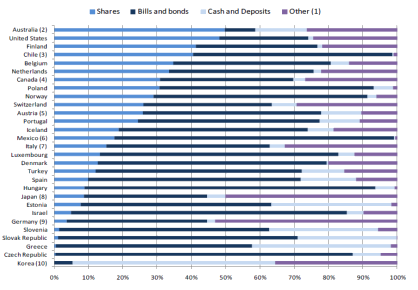

Asset classes found in the portfolios of funded funds are shares, bonds and bills, cash and deposits, loans, land and buildings, unallocated insurance contracts, hedge funds, private equality funds, structured products, other mutual funds (i.e. not invested in cash, bills and bonds, shares or land and buildings) and other86.

Illustration 17: Pension fund asset allocation for selected investment categories in selected OECD countries, 2011, as a percentage of total investment87

86 Other investments means loans, land and buildings, unallocated insurance contracts, hedge funds, private equity funds, structured products, other mutual funds (i.e. not invested in cash, bills and bonds, shares or land and buildings) and other investments.

87 OECD 2012, Pension Markets in Focus, Issue 9, September 2012