Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

2.2. Project development

Following UNIDOs4 “Manual for the preparation of Industrial Feasibility Studies“, the realization phases of IP follow the pre- investment phase, the investment phase and the operating phase.

Given the nature of IP to be almost always unique undertakings with significant investment and long time bound capital the sponsor needs a certain level of confidence to decide about the investment.

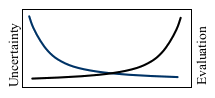

Illustration 2: Uncertainty and evaluation efforts

In the beginning of a project, many topics are subject to uncertainty and the feasibility of the project can hardly be evaluated. The general properties of industrial projects suggest a step wise approach in conceptualization, project definition and fund commitment. The more detailed the studies, the better the definition of the project’s scope and the associated risk and chances.

The investment decision itself is taken on the bases of the study results prepared during the pre-investment phase and the result of the final appraisal report. This shall give sufficient data for the investor to judge about the risk and chance profile to come to a conclusion.

Opportunity studies

The opportunity studies are rather sketchy in nature and rely more on aggregate estimates than on detailed analysis. Cost data are usually taken from comparable existing projects and not from quotations of sources such as equipment suppliers. The project’s chances of being profitable are first checked on basis of the rough data resulting from the opportunity study.

Pre-feasibility studies

The pre-feasibility study analysis the project alternatives as well as the required project preparation. A pre-feasibility study serves as an intermediate stage between a project opportunity study and a detailed feasibility study, the difference being the degree of detail of the information obtained and the intensity with which project alternatives are discussed.

The results of the pre-feasibility study deliver already most of the data required for the specific profitability calculation, though most data is still subject to change and with low accuracy. If the results now still satisfy the investor, he then is releasing funds for the detailed project definition in form of a feasibility study or, if he feels confident enough about it, he is releasing even the investment itself.

Feasibility studies

A feasibility study is very specific and detailed and provides all data necessary for an investment decision. The commercial, technical, financial, economic and environmental prerequisites for an investment project are defined and the result of these efforts is then a project whose background conditions and aims have been clearly defined in terms of its product off-take and marketing, the technology/ capacity of the project and the supply with feedstock and raw material.

The feasibility usually includes environmental impact assessments and to some extends the co-ordination with local authorities to obtain permits.

The final project appraisal report is the summary of all financial, technical and commercial aspects of the project and serves as business plan. The investment decision is based on the expected profitability of the IP and that it creates positive economic value for the investors.

4 UNIDO: Manual for the preparation of Industrial Feasibility Studies, 1991