Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

3.2. Cost of financial capital

Capital is available to an industrial project at certain cost because investors expect to be rewarded for the time the capital is tied-up and not available for other investments (time value of money or cost for risk free investments).

The investor also expects to be returned an “extra” in relation to the probability of not being returned the expected interest in time or in height because of a default (default premium).

Further he expects an additional “extra” to compensate for the volatility of the default probability (risk premium)34.

Both factors, the probability of default and its volatility, depend very much on the order of precedence for repayment and consequently the investor’s expected return (the cost of capital from the projects point of view) correlates to the type of capital, e.g. senior or junior debt or equity.

In all cases the potential investor (loan and equity equally) is calculating the desired minimum interest for the investment by evaluating the possibility of the borrower’s default3536 and comparing the result with possible alternative investments and their relation of possible return and default37.

The premium for default and risk are in general depending on38

- the environment of the investment (political, legal, society, business cycle)

- the market (growth, dynamic, activity, competition, product substitutions, power of customer and supplier, life cycle, outlook)

- the corporation (competiveness, products/ customer value, cost of operation, management, dependency on others)

- Financial structure (profitability, liquidity, stability/ leverage, cash flow)

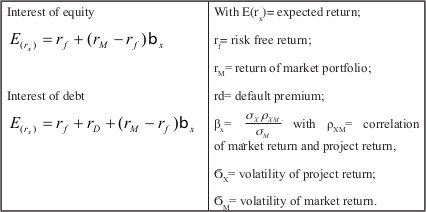

For calculating opportunity cost the capital asset pricing model (CAPM) model could be applied. This model calculates the cost of capital in comparison to a reference investment39 applying the results from the evaluation criteria:

Table 9: Calculating interest for equity and debt with CAPM

The risk free return normally is set by first class treasury bonds. The market portfolio could be the summary of all alternative investments (e.g. MSCI index). The selection of references is at the investor’s sole discretion.

The default premium represents the shifting of statistical expected losses from the lender to the debtor. Calculating a risk premium in the CAPM calculation uses beta as a factor describing the volatility of the investment return in correlation to the reference market return. Both, default premium and risk premium, depend on the project’s exposure to systematic and unsystematic risk (the possibility of diversification) and the leaders portfolio.

Pure financial investors see a project simply as an alternative investment to diversify their investment portfolio and as such the project’s conditions to attract capital have to compete with other investment possibilities on the capital market.

The strategic investor may consider also other factors that may influence the expected interest rate. A strategic investment might be influenced by law and regulation by which the investor’s portfolio is required to include certain assets (e.g. requirement of local content in a Pension Funds portfolio).

34 Volckart p 561

35 Methods to calculate the probability of default are not discussed in this paper

36 Rating agencies calculate the probability of default and publish the results

37 interest paid by alternative investments is also called opportunity cost

38 From multiple sources: e.g. SGBS scriptum, Volckart p 836

39 Volckart p 235; for further discussion about the CAPM refer to Volckart