Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

3.1. Sources of financial capital

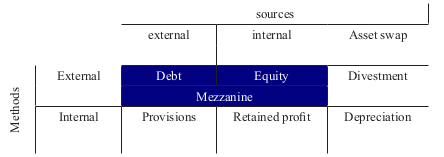

Methods of financing are classified into external or internal methods and external or internal sources24, with the investment as point of reference.

Table 8: Systematic view of financing methods according to Volckart p 81

Internal methods of financing require the existence of a corporate business and are not applicable for start-ups, as a new industrial project would be one. The divestment of assets does also not apply as source for financial capital for the same reasons (there are no assets yet).

The only sources of financial capital for start-ups and newly founded undertakings are equity (shareholding) and debt with differing characteristics25. Mezzanine capital is also a possible source being a hybrid of equity and debt.

Capital in form of equity26 gives the investor rights of ownership so he is empowered to vote and entitled to participate from the value added by the investment. From an accounting perspective equity is the positive or negative remainder of assets after deducting liabilities. The equity entitles to participate from the profit made during the business activities, but only after all claims from other parties have been served. The investor’s profit share is therefore very much depending on the success of the business activities and accordingly volatile27 and subject to unsystematic and systematic risk. Equity also serves as buffer for any losses occurring during the business activities.

Capital in form of (senior) debt gives the investor no ownership rights, and debt capital usually claims interest. Interest for debt capital is not volatile as the height of the interest is fixed in the loan arrangement. Debt can be repaid. The lender’s risk is limited to the possibility of default28. The possibility of default is depending on the covenant agreed to in the loan agreement. Interest for senior debt capital is served with the highest priority of all types of capital.

Mezzanine debt capital is subordinate in priority of payment to senior debt, but greater in rank to equity. It is usually paid an interest, though it may be variable and bound to the success of the investment. It can take the form of convertible debt, debt with warrants or preferred equity. In these cases mezzanine capital fulfils, seen from the senior debt perspective, partly functions of equity and is therefore sometimes referred to as quasi-equity29.

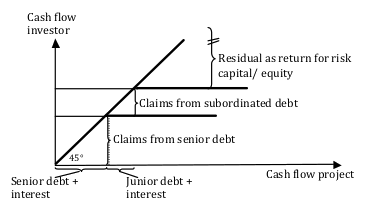

The order of precedence for claims from capital can be illustrated.

Illustration 6: Order of precedence for return to investors30

The main differences between debt and equity can be summarized:

- Debt can be called in, either after a defined period of time or when called by the lender. Equity can not be called in and the funding with equity is always for an indefinite period of time.

- Usually debt capital claims interest, whereas equity is not paid interest (though the investor expects a return in form of dividends).

- Claims from debt capital are served senior to claims from equity capital (In case of default).

Capital can be sourced from the cash and capital market or the credit market31.

Cash and capital market include short term instruments (< one year) like treasury bills or commercial papers, and long term instruments like securities (bonds, shares/ stock).

The credit market works with intermediaries (banks, institutional investors) as they sell credit (asset) on the basis of collected savings accounts (liabilities).

Side note

Side note 1; Debt in form of bonds

Debt as bonds can be placed to institutional investors, often pre-financed by banks, who also take the placement risk. The bond holder receives interest (called coupon), and as bonds can be traded the price of the bond itself is to be negotiated.

Bonds are suitable to transfer differences in the time horizon of the borrower and the lender. Short term investors can sell the bond to long term investors or distribute the bonds to multiple investors.

Brodehser argues that bonds could play a linking role between long term, risk adverse investors and short or mid term and risk affine investors. This is because the strength and weakness of these investors are complementary and the bond could be the corresponding medium32.

financial risk" class="wp-image-11365 size-full" height="228" src="https://sgbs.ch/wp-content/uploads/Illustration-7-Bonds-as-bridge-between-long-term-and-financial-risk.png" width="383"> Illustration 7: Bonds as bridge between long term and financial risk33

24 Volckart p 581

25 Volckart p 491, 581

26 The legal form of a company defines not only juridical aspects but also influences possibilities of shareholding, accounting, corporate control. In the context of this paper the standard legal form is defined as a corporate entity.

27 Volckart p 489

28 From Wikipedia.org (2.Jan 2013): The event of a default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant (condition) of the debt contract.

29 http://bondcapital.ca/learn/ (2.Jan 2013)

30 Böttcher, Blattner p 178, Brodehser p 164

31 Volckart p 811

32 Brodehser p 220, 221

33 Following Brodehser p 221