Rufen Sie uns einfach an, und wir beraten Sie gerne zu unserem Seminar- und Studienangebot.

Unsere Ansprechpartner:

Michael Rabbat, Dipl.-Kfm.

MBA Chief Operating Officer

Claudia Hardmeier

Kunden-Center

Studienbetreuung

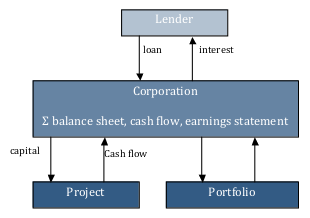

3.3. On balance sheet = corporate financing

If a project is developed by a corporation with already established business activities financial capital can be provided by the corporation.

The borrower (the corporation) guarantees the repayment of the dept. The investor calculates the possibility of default for the entire corporation, not for the project itself. The corporation evaluates the project according to its own procedures and values.

The loan is included into the balance sheet of the corporation and affects the leverage (ratio of dept to equity), which may lead to lower future ratings in creditworthiness as less assets and risk capital is guaranteeing future loan repayments.

Illustration 8: Scheme of corporate financing40

When financing industrial projects through corporate finance, repayment of the financial capital is not bound to the success of only one single project. Moreover the business activity and return of the entire corporation is of interest as the corporate portfolio supplying liquidity and cash flow might serve as a guarantee in case the project itself fails.

40 Own illustration following Reuter